Mastering the Realm of Personal Loans: Unraveling the Top Three Criteria for Optimal Choices

The world of personal loans can be a labyrinth of complexities for many. With a plethora of options available, choosing the optimal loan can be a daunting task. This section aims to demystify the realm of personal loans and set the stage for a comprehensive exploration of the top three criteria for making optimal choices. Personal loans can be a lifeline in times of financial distress. They can be used for a variety of purposes, from consolidating debt to funding large purchases or even covering unexpected expenses. However, the key to leveraging personal loans effectively lies in understanding their intricacies and making informed decisions.

With interest rates, loan terms, and other factors varying considerably across lenders, it becomes crucial to evaluate and compare different loan options. A personal loan that suits one individual's needs and circumstances might not necessarily be the best fit for another. Therefore, it's essential to consider certain critical criteria while on the quest for the optimal personal loan. In the following sections, we will delve deeper into these criteria, providing a comprehensive guide to mastering the realm of personal loans.

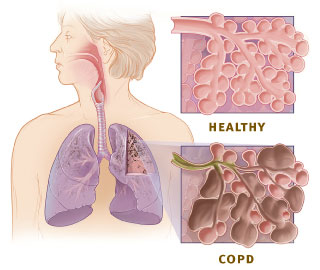

Understanding Your Financial Status – The Foundation of Your Loan Journey

The first key criteria in choosing the optimal personal loan is a thorough understanding of your financial status. This includes your income, expenses, current debts, and credit score. Your financial status acts as the foundation for your loan journey, influencing your borrowing capacity, interest rates, and repayment terms.

A robust income and minimal debts can increase your borrowing capacity and might even fetch you lower interest rates. On the other hand, a low credit score can limit your loan options and result in higher interest rates. Hence, it's crucial to assess your financial status and work towards improving any weak areas before applying for a personal loan. This section underscores the importance of financial health and its role in securing an optimal personal loan.

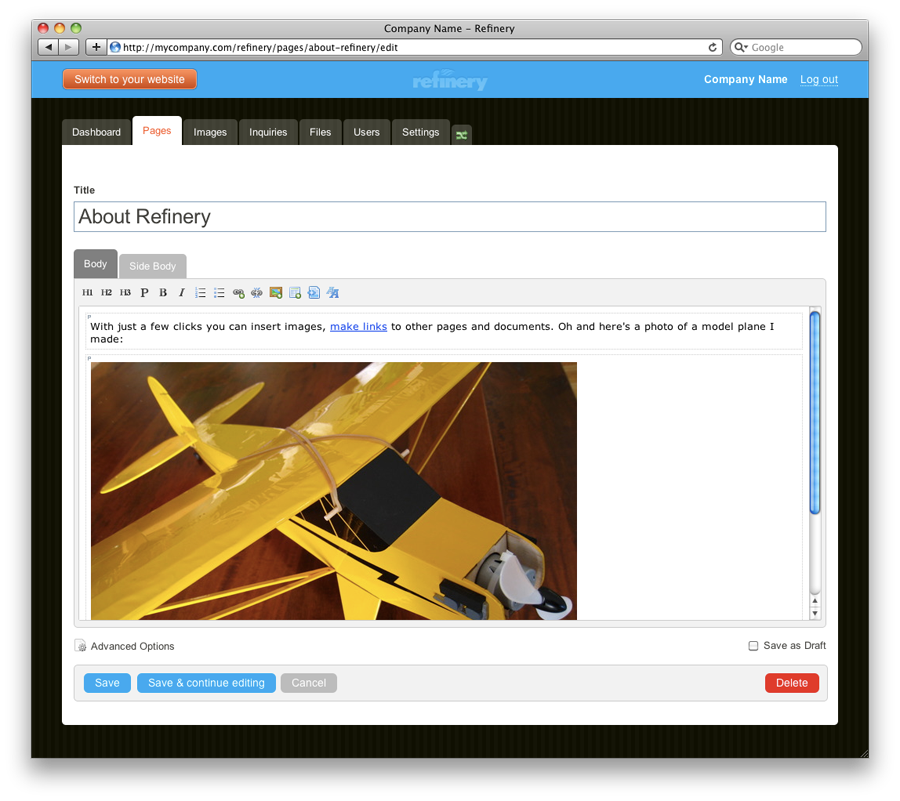

Evaluating Loan Terms – The Blueprint for Your Loan Repayment

The second key criteria for selecting an optimal personal loan is the evaluation of loan terms. Loan terms refer to the specifics of the loan agreement, including the loan amount, interest rate, repayment schedule, and any additional fees or charges. These terms lay the blueprint for your loan repayment, determining the overall cost of the loan and the monthly payments.

A lower interest rate or a longer repayment term can reduce the monthly payments, making the loan more manageable. However, it's essential to remember that a longer term also means paying more in interest over the loan's life. Similarly, additional fees and charges can add to the cost of the loan. Hence, it's crucial to thoroughly evaluate and compare loan terms across different lenders to find the most favorable conditions.

Assessing Lender Reputation – The Assurance of Your Loan Experience

The third key criteria in choosing the optimal personal loan is assessing the reputation of the lender. The lender's reputation can greatly influence your loan experience, affecting the quality of customer service, the ease of application process, and the transparency of loan terms.

Reputable lenders are likely to offer a smooth and transparent loan process, providing clear information about the loan terms and any additional fees or charges. They are also more likely to offer reliable customer service, addressing any queries or issues promptly. On the other hand, lenders with a poor reputation might have hidden charges or complicated loan terms, leading to an unpleasant loan experience. Hence, it's crucial to research and assess the reputation of the lender before finalizing a personal loan.

By understanding your financial status, evaluating loan terms, and assessing the reputation of the lender, you can navigate the realm of personal loans effectively and make optimal choices. These criteria not only ensure a favorable loan experience but also help in managing the loan responsibly, paving the way for financial stability and growth.