Mastering the Mystery of Seniors Life Insurance in Three Simple Steps

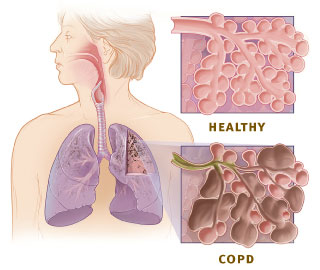

Understanding the inherent importance of seniors' life insurance is the first pivotal step towards mastering the mystery of seniors' life insurance. As people age, their need for life insurance generally differs from when they were younger. Their kids may be grown up with lives of their own, and retirement savings might be in place. Nonetheless, life insurance still plays a crucial role. It can help take care of any remaining debts or final expenses, provide inheritance, or even help pay for grandkids' education.

The most common types of seniors' life insurance include term-life, whole-life, and final expense insurance. Each serves a unique purpose dealing with various aspects of post-retirement life and final expenses. Far too often, seniors find themselves in difficult situations due to unexpected healthcare costs or burdening their loved ones with funeral expenses. Hence, having suitable life insurance becomes crucial.

A comprehensive understanding of these aspects helps in making informed decisions concerning life insurance for seniors. It's vital to tailor-fit the insurance plan according to individual needs, financial situations, and future projections.

Deciphering the Terms and Conditions

Deciphering the terms and conditions of seniors' life insurance represents the second critical phase on this journey. Like any other agreement or contract, life insurance policies can be dense with industry-specific language and terminologies. However, it's crucial to grasp the full extent of these terms and conditions before committing to a policy.

Premiums, which are regular payments made towards the life insurance policy, are an essential term to know. Keep an eye on their frequency and whether they can increase with age. Furthermore, the death benefits, the amount given to beneficiaries after the policyholder's death, must be clarified.

Policy exclusions should also be checked carefully. These list the circumstances under which the insurance company will not pay the death benefits. Understanding these key terms can significantly affect the efficacy and utility of the life insurance policy.

Evaluating and Choosing the Best Policy

The third step towards mastering seniors' life insurance focuses on evaluating and choosing the best policy fitting the unique needs of the individual. It's not merely about getting insured; it's about getting the right kind of insurance.

There are various factors to consider while selecting an apt policy. Cost is a noticeable one, but other factors, such as the financial health of the insurance company, compatibility of the policy with the seniors' needs, and flexibility to alter or upgrade the policy, are equally essential.

Seeking help from an independent advisor can yield beneficial results. They can assist in comparing different insurance policies and companies, understanding the fine print, and negotiating a better deal.

Ongoing Management and Review of The Policy

Mastering seniors' life insurance doesn't end with selecting a policy; it extends to the ongoing management and review of the chosen coverage. Life changes quickly, and therefore it's vital to ensure chosen policies are still tuned with the individual's current circumstances and anticipated future needs.

An insurance policy should never be a 'set and forget' proposition. Regularly revisiting it to check if the assumptions and circumstances under which the policy was originally purchased have changed is essential. If significant life events occur, like the death of a spouse or diagnosis of a severe illness, the policy must be reviewed.

Also, understanding the options for cashing out of a policy or selling it could prove useful. This can provide a substantial sum in the event financial situations drastically change.

Finally, keeping beneficiaries updated and making them aware of the policy details will facilitate a smoother transition when the time arrives. This is an essential part of ongoing policy management.